Why Rafiki

Pricing

Pricing

Solutions

RevOps Leaders

Synchronize revenue generating functions

SDR Leaders

Get your team aligned and Coach your Reps 3x faster at scale

Sales Leaders

Unlock pipeline truth, drive confident forecasts

Customer acquisition is the lifeblood of any sales team. After all, you can't close deals without prospects in the pipeline. However, solely focusing on bringing in new customers can be a short-sighted strategy. While a low customer acquisition cost (CAC) is undeniably attractive, it's equally important to consider the LTV:CAC ratio. This metric sheds light on the long-term value your customers bring to the table, and neglecting it can lead to an unsustainable growth model.

The LTV:CAC ratio stands for customer lifetime value to customer acquisition cost.

LTV or CLTV is customer lifetime value calculated as follows:

CAC is Customer Acquisition Cost - how much it costs you to acquire a paying customer. Not to be confused with CPA (Cost per Acquisition) which is the cost of acquiring a non-paying customer AKA user. CAC is calculated as follows:

In simpler terms, it tells you how much revenue a customer generates over their relationship with your business compared to what it cost to acquire them in the first place.

Let's break it down further. Imagine it costs you $100 to acquire a customer who spends $50 a year with your company, and they stick around for two years. Their LTV would be $100 (50 x 2), resulting in an LTV:CAC ratio of 1. This means it takes you one dollar of customer acquisition cost to generate one dollar of customer value. Not exactly ideal, right?

On the other hand, a healthy LTV:CAC ratio should ideally be greater than 3. This indicates that for every dollar you spend on acquiring a customer, you're generating at least three dollars in revenue over their lifetime. This breathing room allows you to reinvest in marketing and sales efforts to acquire even more high-value customers, fueling sustainable business growth.

A strong LTV:CAC ratio is a powerful indicator of a company's financial health. It signifies that you're not just acquiring customers, you're acquiring the right kind of customers – those who bring long-term value to your business.

The LTV:CAC ratio is a game-changer because it moves the focus beyond the initial win of acquiring a new customer. It compels you to think strategically about the long-term relationship you build with them. Here's why it matters:

In essence, the LTV:CAC ratio provides a holistic view of your customer acquisition efforts. It helps you identify the sweet spot – acquiring customers who bring long-term value to your business, ensuring sustainable growth and profitability.

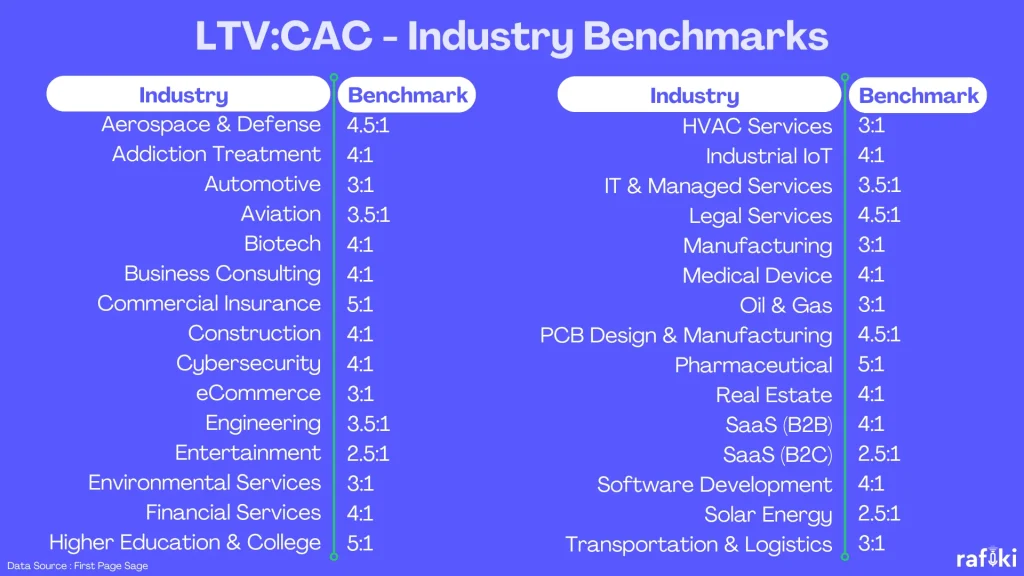

Data Source: First Page Sage

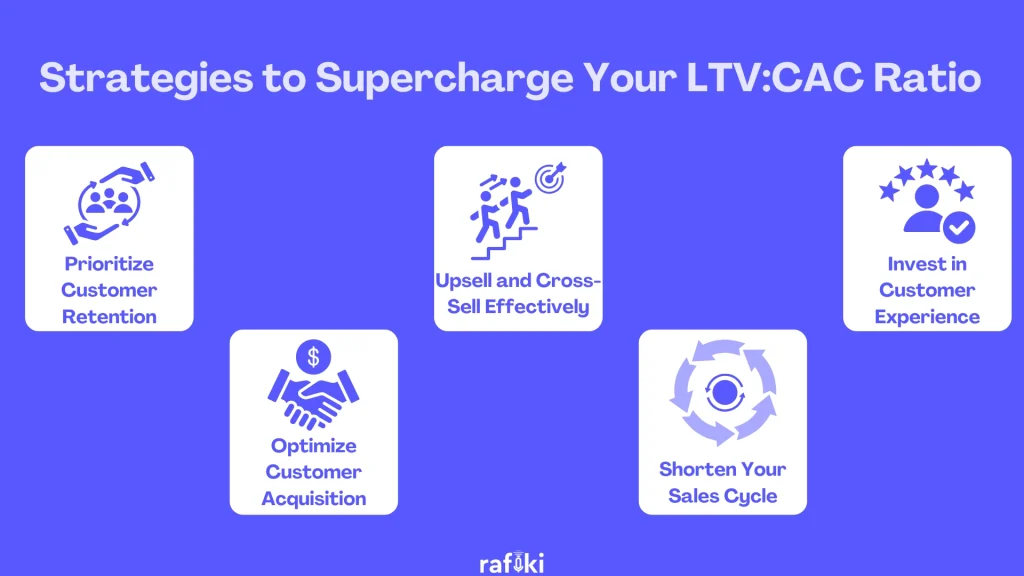

A healthy LTV:CAC ratio is the holy grail for sustainable business growth. But how do you actually improve it? Here are 5 actionable strategies to turn the tide:

It's always cheaper to retain existing customers than acquire new ones. If you’re in SaaS, it’s often 5X cheaper to do so. Focus on building strong customer relationships by providing exceptional customer service. Rafiki's Smart Call Summary can be a game-changer here. By automatically summarizing calls with key takeaways and next steps, reps can ensure they're addressing customer concerns effectively and building trust.

Additionally, implement loyalty programs and offer exclusive benefits to incentivize repeat purchases. Rafiki's Ask Rafiki Anything feature can be a goldmine for uncovering customer churn risks. Simply ask Rafiki to analyze past conversations and identify customers who might be at risk of churning.

Not all leads are created equal. Identify which marketing channels attract high-value customers who convert at a healthy rate.

Rafiki's Lead Scoring powered by advanced AI can be a powerful tool here. By analyzing call conversations, it can automatically score leads based on your specific sales qualification methodology (BANT, MEDDIC, etc.). This allows you to focus your efforts on high-potential leads with a greater chance of converting into loyal, long-term customers. Ditch the scattershot approach and invest in targeted marketing that attracts customers likely to stick around.

Existing customers are a prime audience for upselling and cross-selling, strategies that can significantly boost your LTV.

Rafiki's Smart CRM Sync ensures reps have all the customer data they need at their fingertips. This empowers them to identify upselling and cross-selling opportunities based on a customer's purchase history and preferences. Imagine a rep calling a customer who just purchased a basic software package. With Rafiki's CRM sync, they can see this and suggest an upgrade to a more advanced plan, potentially increasing the customer's lifetime value.

A slow sales cycle can lead to customer fatigue and drop-off. Streamline your sales process by identifying and removing any unnecessary steps. Leverage technology to automate tasks wherever possible.

For example, Rafiki's Smart Follow Up automatically generates personalized emails based on each call, saving reps time and ensuring timely follow-up with prospects. A faster sales cycle means you can convert leads into paying customers quicker, improving your LTV:CAC ratio.

Happy customers are more likely to stay loyal and become brand advocates. Focus on creating a positive customer experience at every touchpoint. This could include offering multiple communication channels (phone, email, chat), providing self-service options, and resolving customer issues promptly.

By leveraging Rafiki's Smart Call Scoring, you can objectively evaluate rep performance and identify areas for improvement. This ensures your sales team is equipped to deliver exceptional service calls, fostering happy and loyal customers who contribute to a healthy LTV:CAC ratio.

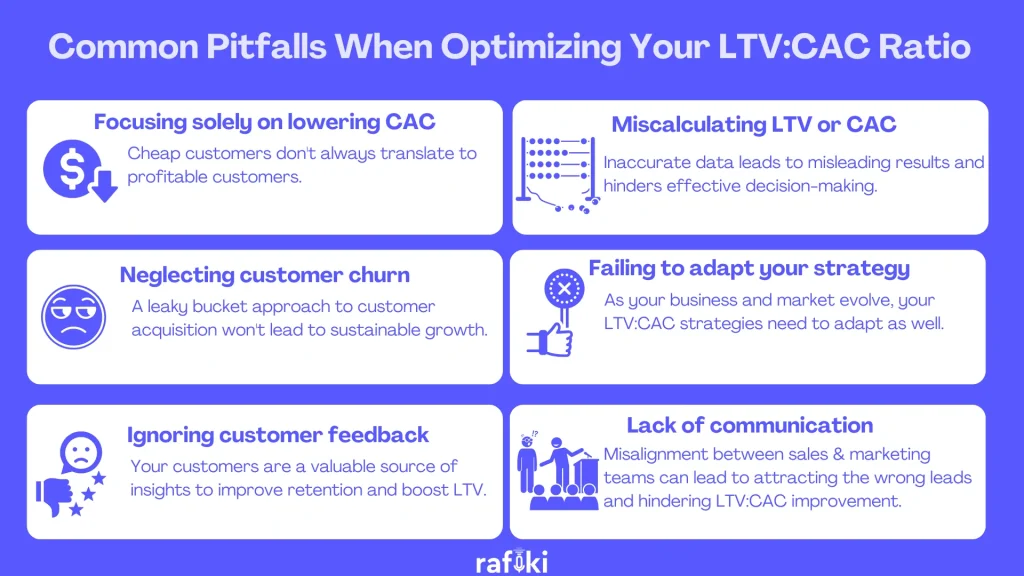

Now that you know the strategies, here are a few common pitfalls that you should be aware of in this journey:

The LTV:CAC ratio is a powerful metric for understanding the long-term health of your customer base. By focusing on not just acquiring customers, but acquiring the right kind of customers who bring lasting value, you can achieve sustainable growth.

Keep in mind, it's a continuous journey. Regularly monitor your LTV:CAC ratio, implement the strategies outlined above, and leverage technology like Rafiki to gain valuable customer insights. By optimizing your customer lifecycle, you can turn your customer base into a powerful engine for long-term success.

Take Control of Your LTV:CAC Ratio